For many Canadians, charitable giving isn’t just about taxes – it’s about making a difference. But changes to the Alternative Minimum Tax (AMT) might make generosity a little more complicated, especially for ...

How Canada’s 2025 Tax Measures Empower Residential Developers

Canada’s housing shortage remains a critical challenge in 2025, but recent federal initiatives are giving residential developers new tools to boost affordability and improve project viability. Through enhanced depreciation incentives ...

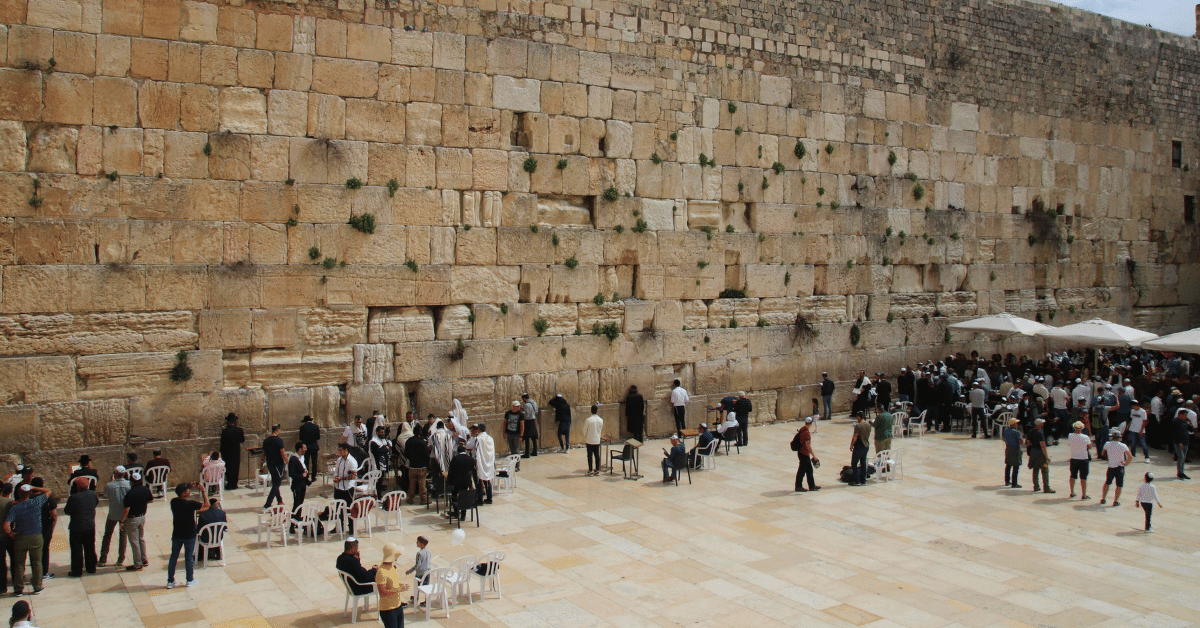

Taxation of Immigrants to Israel: A Canadian Perspective

For many Canadians, making Aliyah—immigrating to Israel—is a significant life decision rooted in cultural, religious, or personal reasons. However, it’s also a complex financial transition that requires a thorough understanding ...

Are Tax Rate Differentials Giving Some NHL Teams an Edge?

Hockey is about skill, strategy, and teamwork—but in today’s NHL, tax policies might play a surprising role in shaping team success. Teams based in U.S. states with no state income ...

What does the Capital Gains Inclusion Rate Increase Look Like for You?

This year’s Federal budget marked the first increase to the Capital Gains inclusion rate since 2000, an announcement that many criticized as having significant consequences on both high income and ...

The Struggle of Distressed Condo Projects in Today’s Economy

The Boom and Bust of Urban Development In recent years, urban development has thrived, with inner-city properties like former parking lots, theaters, and unused spaces transforming into high-demand condo projects. ...

Unlock Your Path to Homeownership: The Power of Tax-Free First Home Savings Accounts!

Are you dreaming of owning your first home but worried about saving up for it? Enter the First Home Savings Account (FHSA), a brilliant solution tailored for first-time homebuyers in ...

Navigating Halal Mortgages in Canada: A Guide to Shariah-Compliant Home Financing

Did you know that Canada’s Islamic population comprises approximately 1.7 million people, accounting for 4.9% of the total Canadian population as per the 2021 census? Until recently, fulfilling the dream ...