Canadians who want to sell their vacation properties in the U.S. are surprised to discover that the IRS requires 15% withholding on the gross proceeds they will receive on the ...

Attention Snowbirds: Your U.S. Stay May Trigger Tax Obligations

For Canadian snowbirds who spend extended periods in the U.S., it’s important to be aware that your time south of the border could trigger U.S. tax filing requirements. Even if ...

Net Investment Income Tax Ruling, and Good News for US Expats

IRS Overruled & Potential Refunds If you are a US expat taxpayer, the latest court ruling comes as welcome news to you. A US federal court has overturned a controversial ...

What Trump’s Victory Means to Canadians Doing Business in the U.S. and American Expatiates Living in Canada

Donald Trump’s victory coupled with what appears to be a Republican sweep of both houses of Congress sets the stage for tax legislation to be passed early in Trump’s term. ...

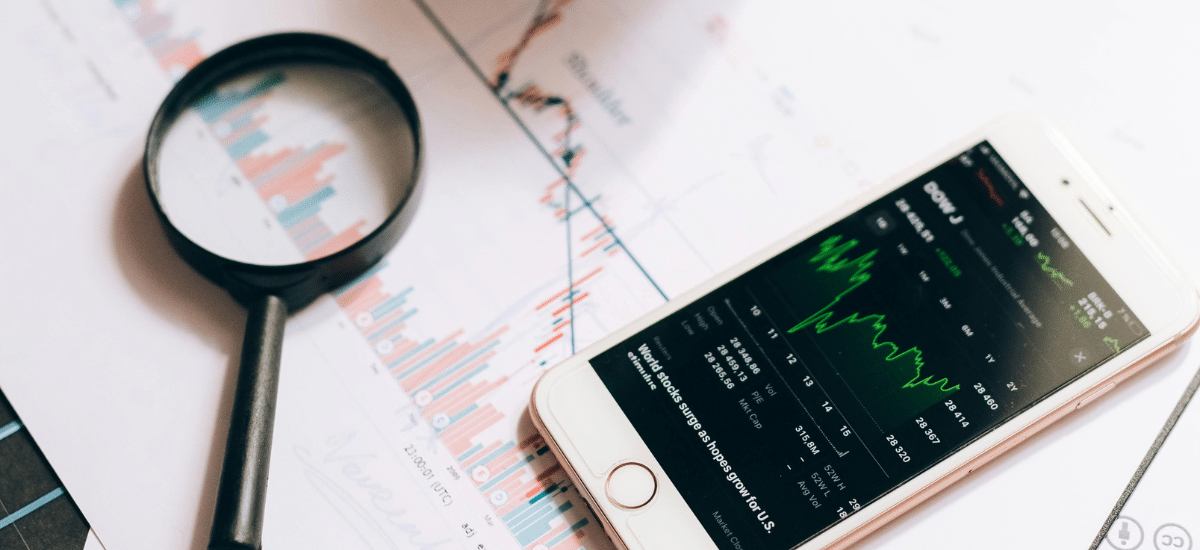

Navigating Economic Shifts: Cruising at a High Altitude

In the face of shifting geopolitical dynamics, this blog dives into the Canadian and U.S. economic landscapes focusing on the current challenges including the housing supply crisis, high interest rates, ...

Get Ready for 2024; It’s Time for Some Belt Tightening

Are you wondering what strategic measures enterprises can undertake to position themselves favorably for 2024? In this blog, we will delve into the prevailing economic landscape in Canada, the United ...

TFSAs for U.S. citizens: might be worthwhile with some caveats

Since the Tax-Free Savings Account (TFSA) was introduced in 2009, it has been used by Canadians to earn investment income on a tax-free basis. Many U.S. citizens, however, have shied ...

Circuit court derails constitutional argument against the repatriation tax

In late 2017, the US Congress passed the Tax Cuts and Job Act (“TCJA”) which was signed into law by then President Trump on December 22, 2017. One of TCJA’s ...

Exploring Section 1031 Rollover in US Real Estate for Canadians

With current low capitalization rates in the Canadian real estate market, many Canadians are looking south of the border to the United States for higher returns on their real estate ...