Small business owners have a lot on their plates. A smaller team means in many cases that the owners have to wear multiple hats, playing several different roles at once. ...

Navigating Tax Hurdles in Family Business Succession: The New Intergenerational Share Transfer Rules

Canada’s capital gains deduction is a powerful tax break available to Canadian-resident individuals who sell shares in a Qualified Small Business Corporation (QSBC). It allows up to $1.25 million in ...

Keeping it in the Family: Estate Planning for Business Owners

Running a family business isn’t just about today—it’s about building something that lasts for generations. That’s where estate planning comes in. It’s not just about legal documents and tax strategies; ...

Selling a U.S. Property – Should One File a Form 8288 for a Deduction in U.S. Taxes?

Canadians who want to sell their vacation properties in the U.S. are surprised to discover that the IRS requires 15% withholding on the gross proceeds they will receive on the ...

Estate Planning During Major Milestones: What to Know When Remarrying

Ontario’s estate laws have significantly changed in the last few years, making it much more important to review your will after serious life events like a re-marriage or separation. While ...

Attention Snowbirds: Your U.S. Stay May Trigger Tax Obligations

For Canadian snowbirds who spend extended periods in the U.S., it’s important to be aware that your time south of the border could trigger U.S. tax filing requirements. Even if ...

How Canada’s New AMT Rules Could Impact Your Charitable Donations

For many Canadians, charitable giving isn’t just about taxes—it’s about making a difference. But recent changes to the Alternative Minimum Tax (AMT) might make generosity a little more complicated, especially ...

Are Tax Rate Differentials Giving Some NHL Teams an Edge?

Hockey is about skill, strategy, and teamwork—but in today’s NHL, tax policies might play a surprising role in shaping team success. Teams based in U.S. states with no state income ...

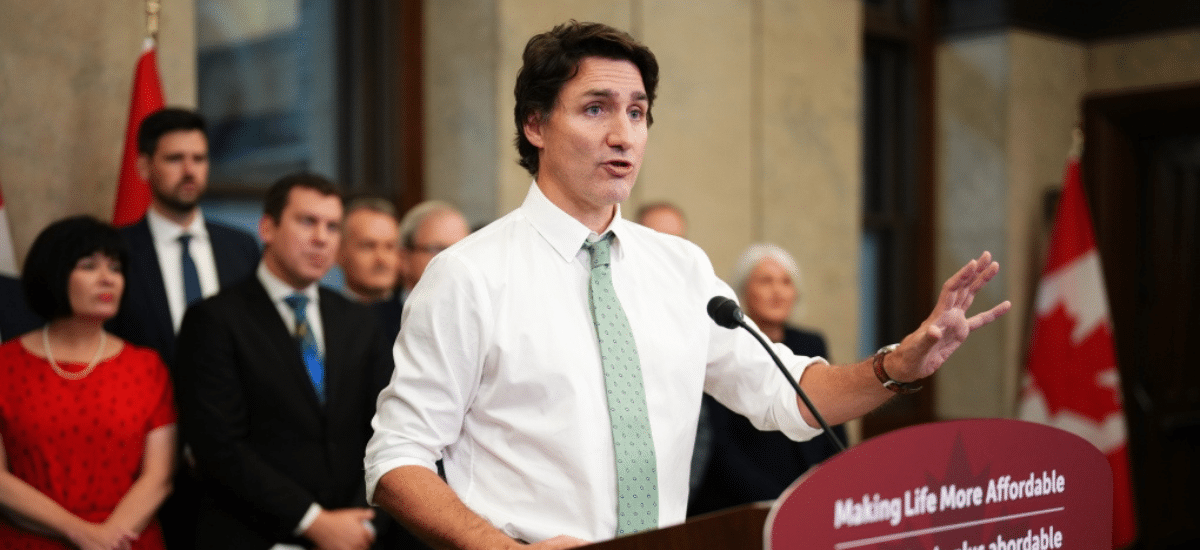

A Tax Break for all Canadians

In an effort to reduce Canadians’ tax burden during the holiday season, the Federal government announced on Thursday that the majority of expenses will be temporarily free from GST/HST from ...