Insights

Starting a Small Business in Ontario in 2026: What to Think About Before You Spend Your First Dollar

Most people don’t start a business because they love paperwork. They start because they see an opportunity. Or they are tired of working for someone else. Or they want to ...

Insights

Capital Gains and the 2017 Federal Budget

The tax hit on capital gains has not changed much in Canada over the last sixteen years. That might change, however, when the Canadian government releases its upcoming budget. Nathan ...

Springbank Capital Exclusive Financial Advisor to Cido Research

We are pleased to announce in October of 2016, The Logit Group, a leading Canadian research execution company, has acquired Cido Research Americas, a trusted international data collection company, to ...

Springbank Capital Exclusive Financial Advisor to Help Desk

We are pleased to announce in September of 2016, Help Desk Technology Group was acquired by B.I.G. Capital LLC. Springbank Capital, an affiliate of Zeifmans, acted as the exclusive financial ...

Springbank Capital Exclusive Financial Advisor to Consolidated Bottle Corporation

We are pleased to announce that on February 3, 2016, Consolidated Bottle Corporation received financing from TD Asset Finance to fund growth and production capacity. Springbank Capital, an affiliate of ...

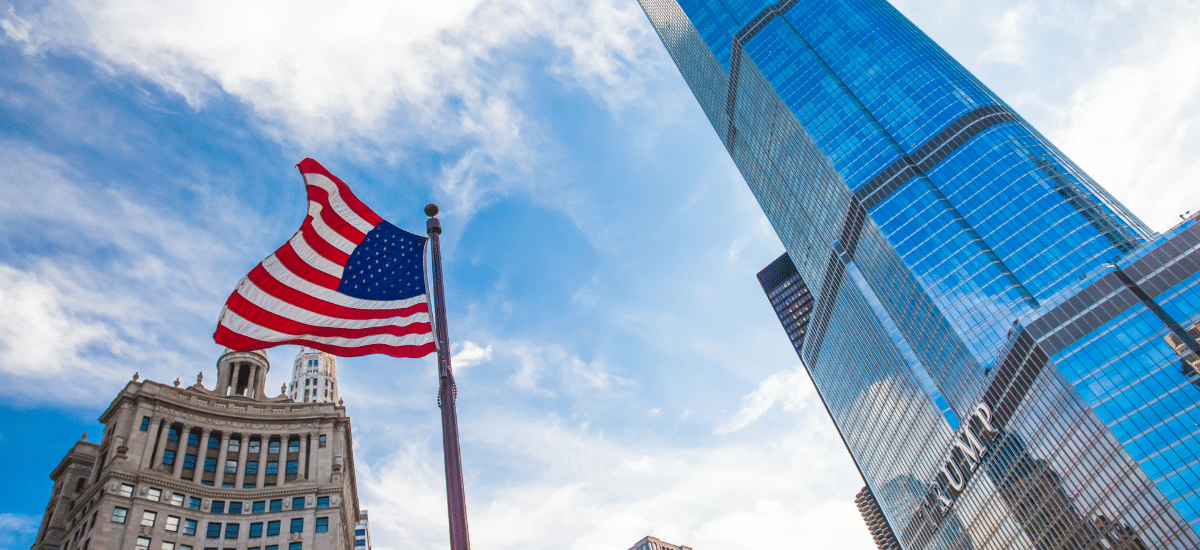

The U.S. Election Hangover: What Canadians Can Expect on the Tax Front from a Trump Presidency

For the first time in 88 years, Americans have elected a Republican President and Republican majorities in both house of congress in this past U.S. election. The election provides an ...

Changes to Life Insurance Policies and the Implications on Estate Planning

As of December 31st, 2016, the Federal Government will be implementing changes to Life Insurance policies. These legislative changes will not only result in higher insurance costs, but will also ...

US Citizens: Owning a Professional Corporation by Stanley Abraham, as published by the Canadian Tax Federation

US citizens who are resident in Canada and own an interest in a corporate professional practice (such as a medical practice ) should consider their exposure to the passive foreign ...

Springbank Capital Corp. advises El-En Packaging and Haremar Plastic Manufacturing on recent sale to Inteplast Group

Springbank Capital Corp. is pleased to announce that, on March 2, 2015, Inteplast Bags and Films Corporation (a division of Inteplast Group) acquired El-En Packaging Company and its sister company, ...

The time for Canadian-Israeli business investment is now

IBM. Microsoft. Google. Intel. Samsung. Facebook. Some of the biggest names in technology have collectively invested billions of dollars in Israel-based companies – and the reasons are simple. Find out ...