According to 2016 Census of Agriculture, there are 193,492 farms operating in Canada. While the total number of farm operators is declining, the average age of a Canadian farmer is increasing, with ...

2019 Federal Budget Commentary

Finance Minister Bill Morneau released his 2019 Federal Budget on March 19, 2019. The Budget forecasts a deficit of $14.9 billion for the 2018-2019 fiscal year, but is expected to ...

Potential protective refund opportunity for US citizens impacted by repatriation tax

Our US citizen client base had been significantly and adversely impacted by the repatriation tax imposed on the retained earnings of their Canadian corporations. An opportunity may exist to file ...

Estate Planning: Best conducted early, and often

Remember the fable about the ant and the grasshopper? The grasshopper hedonistically enjoys the summer and perishes when the winter arrives. Meanwhile, the ant works hard to prepare for winter ...

Zeifmans TOSI & 2018 Tax Update

In November 2018, Zeifmans hosted two TOSI (Tax on Splitting Income) & 2018 Tax Update Breakfast and Learns at our office, in Toronto, Canada. Presenters, Jonah Bidner and Nathan Jung discussed ...

Implications for property owners using Airbnb for extra income

Have you ever thought about using Airbnb for extra income? Since Airbnb launched in 2009, it has become a dominating player in the hospitality industry, offering those seeking overnight stays ...

So you closed a big real estate deal – now what?

So you finally closed that big real estate deal and are left with significant funds in your corporation. You have now moved onto to evaluating various investment options, looking at ...

Landmark case changes the game for purchasers of real estate property in Canada

As discussed in an earlier blog post, Dealing with Canadian real estate owned by a non-resident? Know the process to ensure you avoid costly errors, when one purchases a real ...

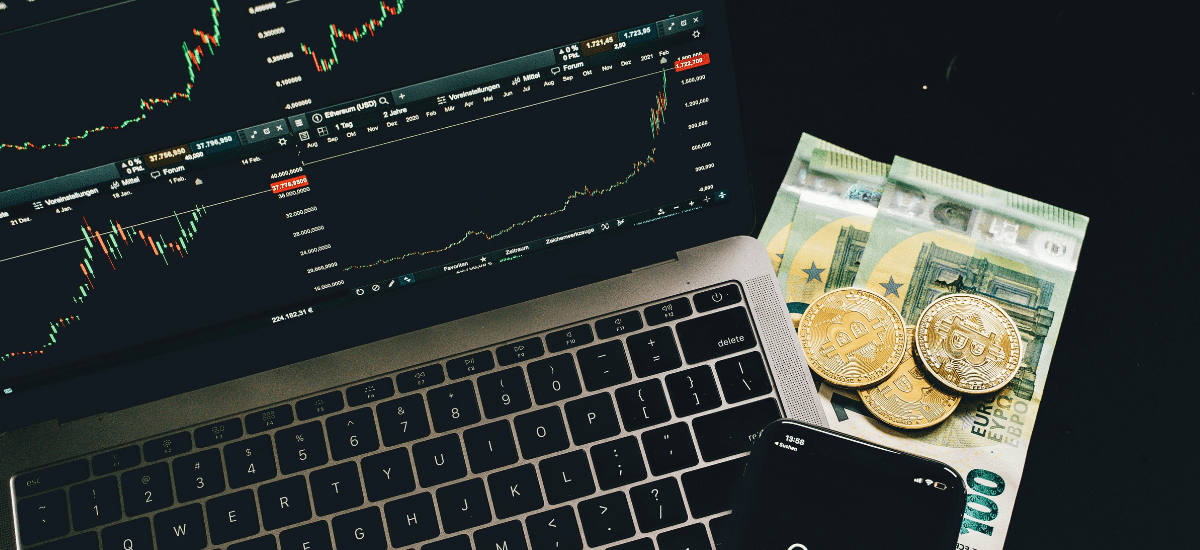

The ins and outs of income tax when using cryptocurrencies

Cryptocurrencies has developed into a sizzling topic over the last 2 years. Trending digital currencies such as Bitcoin and Ethereum have increased in value resulting in significant market capitalization, transactional ...