When someone leaves you a property after death, it’s a mix of emotions: grief, memorial of the loss, and maybe concern about possible tax implications. In Canada, there’s no inheritance ...

Navigating Leadership: When a Non-Family CEO Leads a Family Business

Family businesses are the foundation of the Canadian economy. They represent more than 60 percent of private sector firms and employ close to seven million Canadians1. These enterprises carry not ...

Canadian Tax Tips Every Influencer Needs to Know

As the influencer marketing sphere continues to grow through platforms like Twitch, YouTube, Twitter, TikTok, and Instagram – reaching a global $21.1 billion valuation in 2023 – Canadians are capitalizing ...

Strategic Use of Multiple Wills in Canadian Estate Planning: Navigating Probate Fees

Creating multiple wills is a practice that has been associated with estate planning in Canada, particularly in provinces like Ontario for the last 20+ years. The primary reason people create ...

Why an Annual Financial Plan Review is Essential

Creating an effective financial plan takes thought and careful preparation. Once your plan is complete, and the steps towards your goals are set in motion, it’s tempting to check the ...

The One Big Beautiful Bill: Attention Founders and Early Investors!

Treatment of Qualified Small Business Stock (“QSBS”) is a prized tool for founders to raise capital and for early investors to utilize in building equity that can be practically tax ...

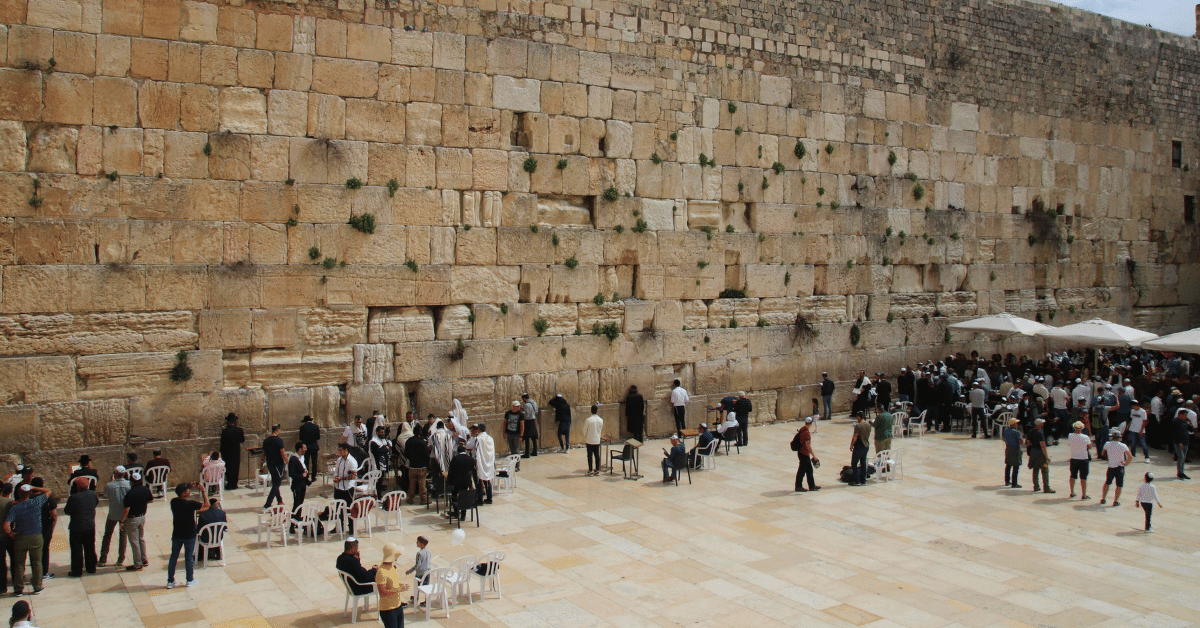

Taxation of Immigrants to Israel: A Canadian Perspective

For many Canadians, making Aliyah—immigrating to Israel—is a significant life decision rooted in cultural, religious, or personal reasons. However, it’s also a complex financial transition that requires a thorough understanding ...

US Tax: Is the One Big Beautiful Bill For Me?

You’ve seen the red-carpet rollout for President Trump’s One Big Beautiful Bill (OBBB), the flurry of articles, webinars and analysis that ensued, but are still wondering…what does this have to ...

Succession Planning and Tax Planning: Two of a Kind

Small business owners have a lot on their plates. A smaller team means in many cases that the owners have to wear multiple hats, playing several different roles at once. ...