While 2017 saw a bit of a slump for residential properties in Canada, certain markets remained strong (Vancouver, for instance), while real estate investment properties across the country were largely ...

Canadians’ investment in U.S. real estate after tax reform

Amid sizzling real estate markets in places like Toronto and Vancouver that have driven prices North of the border sky high, Canadians have been looking South for opportunities to profit ...

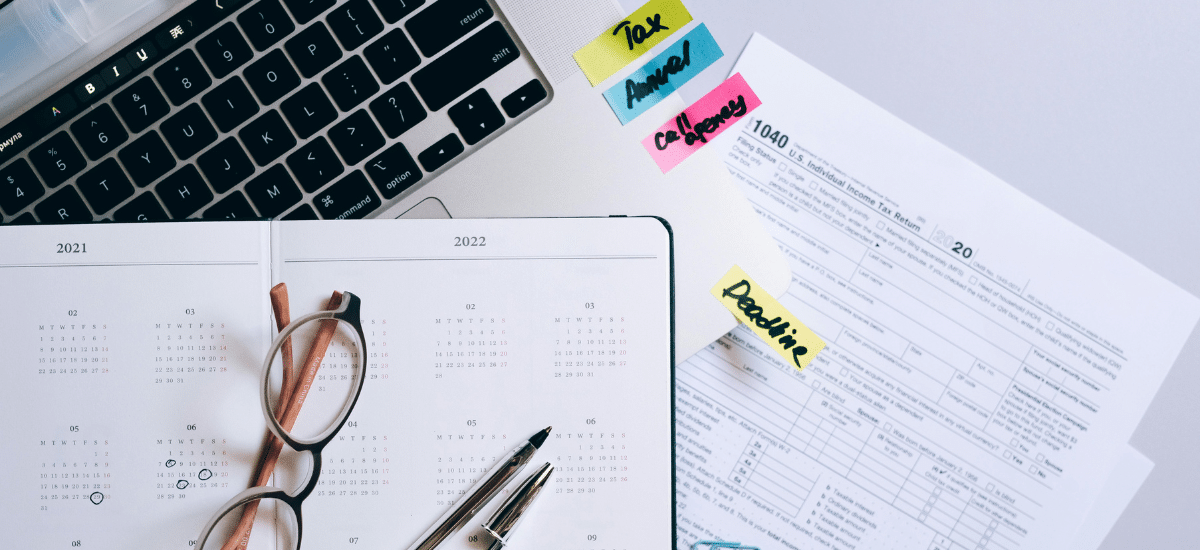

Recent U.S. tax reform impacts Canadians doing business in the U.S.

The recent U.S. tax reform has provided Canadian-based multinational businesses some powerful incentives to shift production to the U.S. – lowered tax rates, particularly for U.S. exporters, and accelerated write ...

Recent U.S. tax reform impacts U.S. citizens living in Canada

The U.S. is in the process of enacting the broadest change to its tax system since 1986. Rather than analyzing each change, the following 2-part series will focus on the ...

U.S. tax reform bills have significant impact on U.S. citizens in Canada and Canadian entities conducting business in the U.S.

Both houses of the U.S. Congress have passed different but similar U.S. tax reform bills. The differences will be reconciled by a joint committee of congress and the revised bill ...

Significant U.S. tax exposures for Canadian family trusts with U.S. beneficiaries or U.S. Settlors/Grantors

As most are aware, the IRS has undertaken an initiative to identify unreported foreign income of U.S. taxpayers. While most of the attention has been focused on U.S. expatriate citizens ...

Highlights of the proposed Trump Tax Plan

President Donald Trump has released a brief document outlining what his administration is calling “the biggest tax cut in U.S. history”. Canadians should not assume the proposed Trump Tax Plan ...

Top Ten Real Estate Financial Management Tips for in 2017

Real estate has been one of the hottest investment vehicles across Canada in recent years, and 2017 is shaping up to be no different. To make sure your real estate ...

The U.S. Election Hangover: What Canadians Can Expect on the Tax Front from a Trump Presidency

For the first time in 88 years, Americans have elected a Republican President and Republican majorities in both house of congress in this past U.S. election. The election provides an ...