Most people don’t start a business because they love paperwork. They start because they see an opportunity. Or they are tired of working for someone else. Or they want to ...

Tougher Tax Policy on Foreign Payments

If tariffs on inbound goods were not enough to shift economies and change US taxpayers’ behaviour, a new bill aims to levy a 25% excise tax on outsourcing payments to ...

The One Big Beautiful Bill: Attention Founders and Early Investors!

Treatment of Qualified Small Business Stock (“QSBS”) is a prized tool for founders to raise capital and for early investors to utilize in building equity that can be practically tax ...

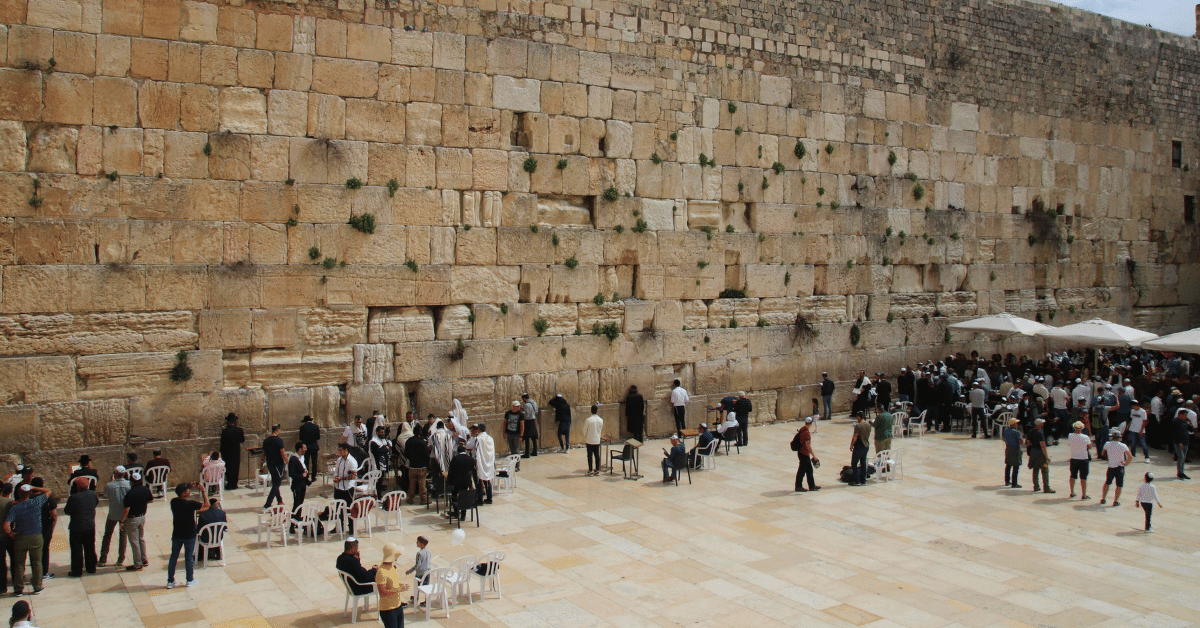

Taxation of Immigrants to Israel: A Canadian Perspective

For many Canadians, making Aliyah—immigrating to Israel—is a significant life decision rooted in cultural, religious, or personal reasons. However, it’s also a complex financial transition that requires a thorough understanding ...

US Tax: Is the One Big Beautiful Bill For Me?

You’ve seen the red-carpet rollout for President Trump’s One Big Beautiful Bill (OBBB), the flurry of articles, webinars and analysis that ensued, but are still wondering…what does this have to ...

Selling a U.S. Property – Should One File a Form 8288 for a Deduction in U.S. Taxes?

Canadians who want to sell their vacation properties in the U.S. are surprised to discover that the IRS requires 15% withholding on the gross proceeds they will receive on the ...

Attention Snowbirds: Your U.S. Stay May Trigger Tax Obligations

For Canadian snowbirds who spend extended periods in the U.S., it’s important to be aware that your time south of the border could trigger U.S. tax filing requirements. Even if ...

Are Tax Rate Differentials Giving Some NHL Teams an Edge?

Hockey is about skill, strategy, and teamwork—but in today’s NHL, tax policies might play a surprising role in shaping team success. Teams based in U.S. states with no state income ...

Net Investment Income Tax Ruling, and Good News for US Expats

IRS Overruled & Potential Refunds If you are a US expat taxpayer, the latest court ruling comes as welcome news to you. A US federal court has overturned a controversial ...