Cryptocurrencies has developed into a sizzling topic over the last 2 years. Trending digital currencies such as Bitcoin and Ethereum have increased in value resulting in significant market capitalization, transactional ...

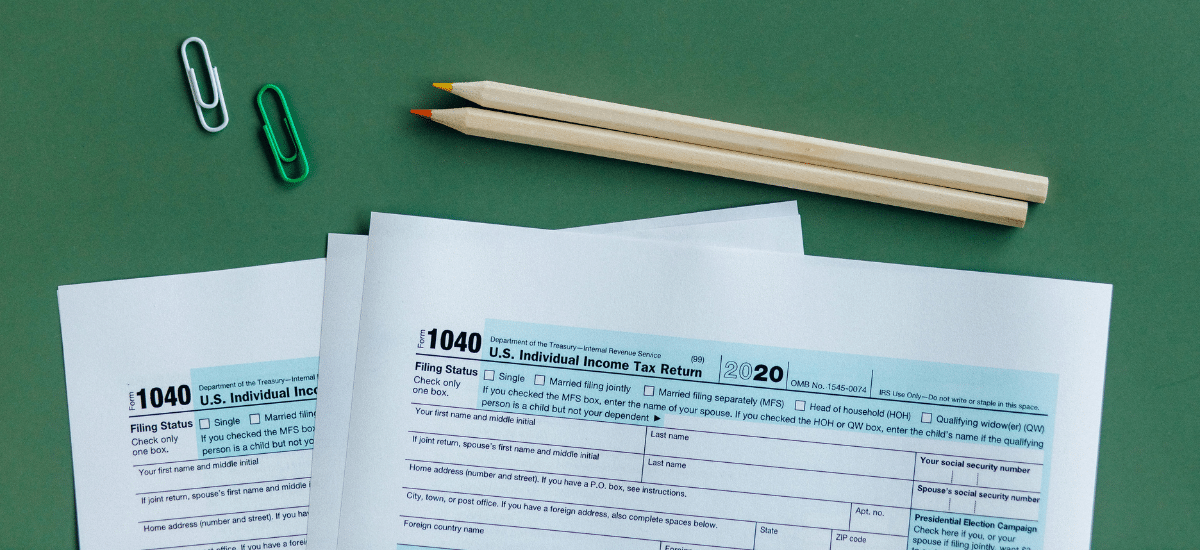

Navigating the U.S. e-commerce state sales tax collection rules

On June 21, 2018, the U.S. Supreme Court ruled 5-4 in favour of allowing South Dakota to impose an e-commerce sales tax by Wayfair Inc. (“Wayfair”), a large online furniture ...

Update for CFC owners on mitigating the impact of U.S. tax reforms

U.S. citizens abroad who own an interest in a Controlled Foreign Corporation (“CFC”) have been unfairly targeted by two provisions of the U.S. tax reform that was legislated at the ...

Doing Business Globally: A Tax Update

In June 2018, in conjunction with hosting the international tax conference of Nexia International – a global network of independent accounting and consulting firms and one of the top ten global ...

GILTI or Not GILTI: A guide for U.S. expatriates living in Canada

First, expatriate U.S. citizens who owned a direct or indirect interest in a Canadian corporation had to deal with an unfair transition tax on the amount of earnings and profits ...

Do you own a U.S. enterprise? You may be required to complete the BE-12 benchmark survey by May 31, 2018

A U.S. business enterprise includes any organization, association, branch, or venture which exists for profit making purposes or to otherwise secure economic advantage, and any ownership of any real estate ...

The new income sprinkling rules: Part 3 – The third, fourth and fifth exceptions from the TOSI rules

In parts one and two of this series, we looked at the main changes to the legislation, as well as the first two exceptions from the TOSI rules. In part ...

The new income sprinkling rules: Part 2 – The first and second exceptions from the TOSI rules

New legislation regarding the use of income sprinkling rules came into effect on January 1, 2018. Referred to as the “Tax on Split Income”, or “TOSI”, the intention of the ...

The new income sprinkling rules: Part 1 – What has changed under the new TOSI legislation?

On December 13, 2017 the federal government released legislation with the intent to simplify the income sprinkling rules (referred to as the Tax On Split Income or TOSI) previously released ...