If you own a family business, succession planning probably feels like a loaded topic. Not because you do not care about the future, but because it feels like once you ...

2025 Year End Tax Considerations: What Individuals and Business Owners Should Review Before December 31

Year-end has a way of sneaking up on everyone. The final weeks of the year are often packed with project deadlines, budgeting for the new year, and holiday chaos. Yet ...

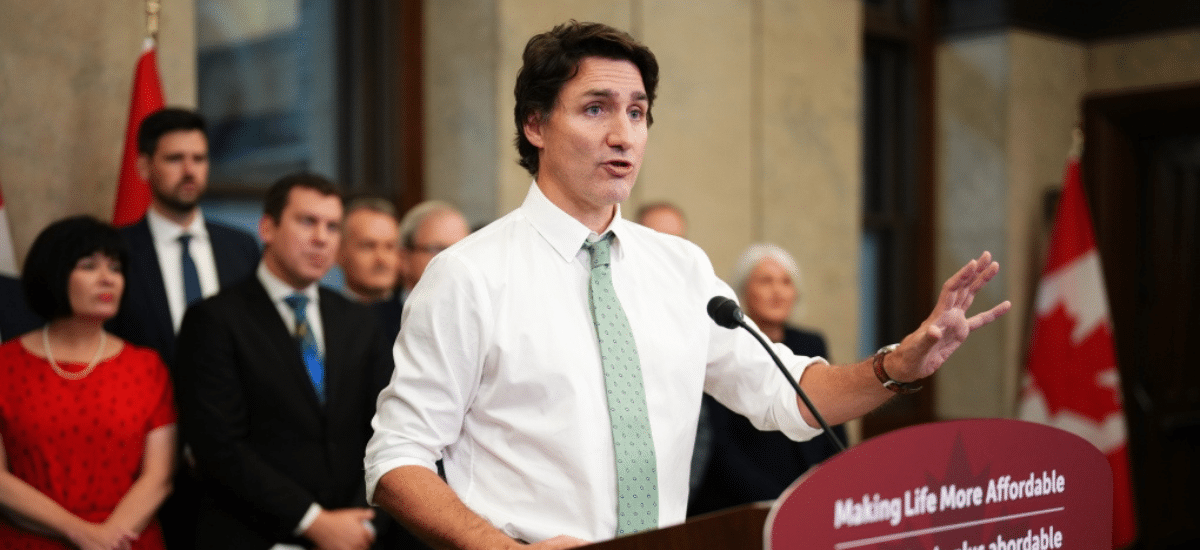

Capital Gains Inclusion Rate Change Postponed: What It Means for You

For months, investors and business owners across Canada were preparing for a major shift in tax rules. Ottawa had planned to increase the capital gains inclusion rate in June 2024. ...

Navigating Tax Hurdles in Family Business Succession: The New Intergenerational Share Transfer Rules

Canada’s capital gains deduction is a powerful tax break available to Canadian-resident individuals who sell shares in a Qualified Small Business Corporation (QSBC). It allows up to $1.25 million in ...

A Tax Break for all Canadians

In an effort to reduce Canadians’ tax burden during the holiday season, the Federal government announced on Thursday that the majority of expenses will be temporarily free from GST/HST from ...

Ontario’s Fall Economic Statement Offers a Promising Financial Outlook Along with Tax Cuts and AMT Rate Decreases

Ontario’s latest Fall Economic Statement showed signs of significant financial growth, mainly due to falling interest rates and higher tax revenues. While residents are still feeling the effects of a ...

2024 Budget Balances Capital Gains Rate Hike with a Number of Tax Credits and Exemptions

The 2024 Federal Budget, presented by Finance Minister Chrystia Freeland on April 16, introduced $52.9 billion in new spending, which the government plans to offset, in part, by increasing taxes ...

Navigating Canada’s Latest Trust Reporting Legislation Changes

The government’s new federal trust reporting rules will increase disclosure requirements, affecting a wide range of Canadian trusts. Originally, the federal government introduced significant changes to trust legislation in 2018 ...

Congratulations Jane Xu!

We are proud to congratulate Jane Xu (Team SIR) on successfully completing the 2023 Common Final Exam (CFE) and continuing her professional journey towards becoming a Chartered Professional Accountant. Congratulations on this significant achievement! All ...